The United States doesn’t have a real economy

Thanks to a decades-long inflationary Federal Reserve monetary policy, the U.S. economy is nothing more than a bubble

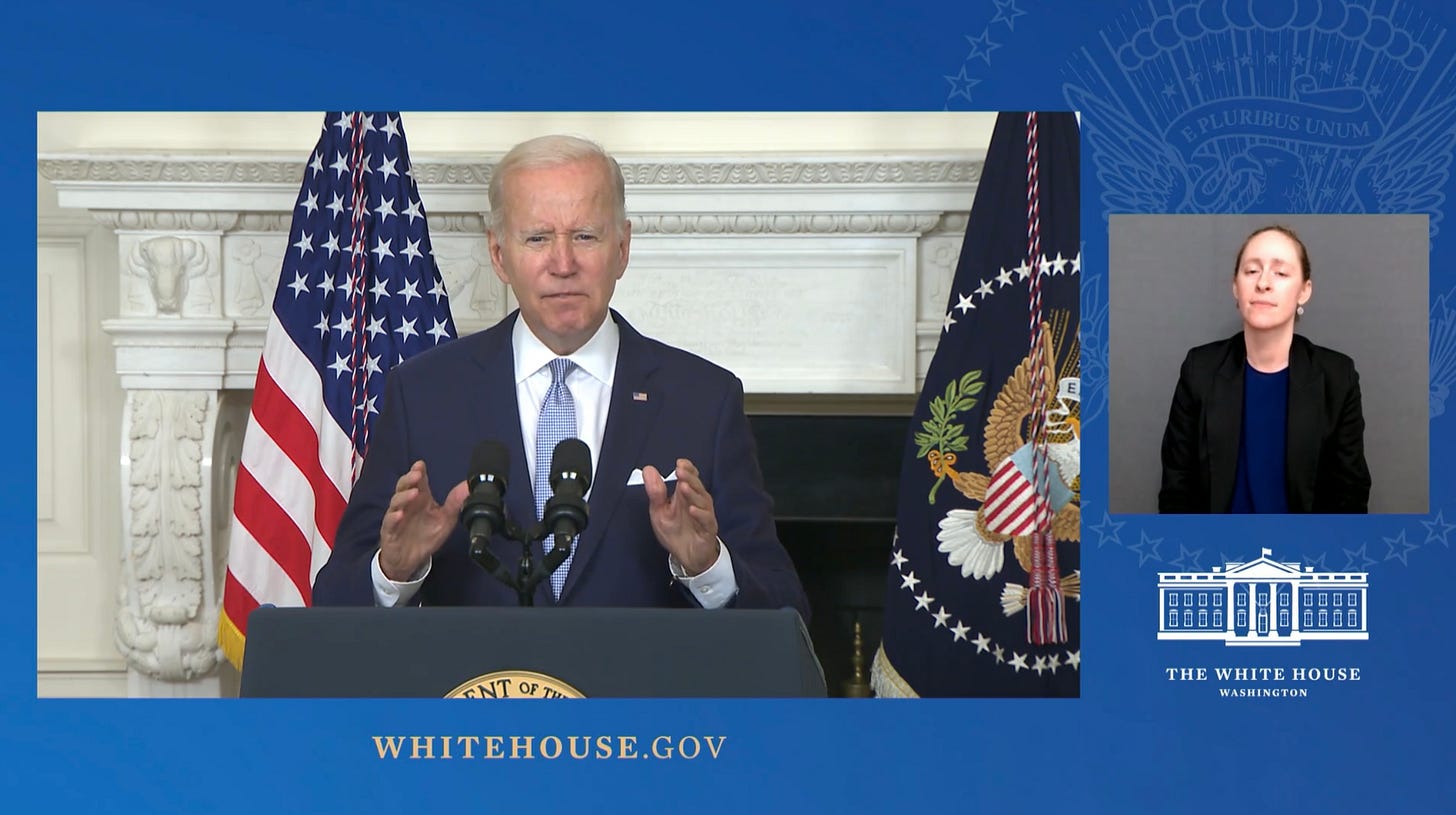

The regime has a vested interest in American citizens being ignorant of how the economy works and President Biden’s latest statement on the second quarter GDP numbers is yet another example of this. Before we get into what Biden said, let’s look at the GDP numbers themselves. From CNBC:

The U.S. economy contracted for the second straight quarter from April to June, hitting a widely accepted rule of thumb for a recession, the Bureau of Economic Analysis reported Thursday.

Gross domestic product fell 0.9% at an annualized pace for the period, according to the advance estimate. That follows a 1.6% decline in the first quarter and was worse than the Dow Jones estimate for a gain of 0.3%.

GDP itself is not really an accurate measure of the health of the economy as it essentially just adds up any economic activity that takes place in a given time period, and it includes government spending as a benefit to the economy rather than subtracting government spending as the drain on the economy that it is. And if the official, overblown numbers are telling us the economy is bad, then the real numbers are much worse. In light of this, the argument over whether we’re in a recession is nothing more than a joke.

President Biden’s statement is designed to downplay the fact that the economy is in a recession and convince people that the economy must be stronger than they know it to be. One sentence in particular stood out to me, however: “It’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation.” This is true, but it’s only true when your economy is not built on real economic growth but rather built on inflation from your central bank.

In his statement, Biden was referring to price inflation, rising prices, when he said inflation, but in reality the definition of inflation is an increase in the supply of money in comparison to the amount of goods and services in the economy. During the COVID-19 pandemic, under both the Trump and Biden regimes, the Federal Reserve created inflation both to avoid a recession and to send out money to people in the form of stimulus packages.

Remember that Trump was constantly complaining about Fed Chairman Powell’s interest rate moves during his time in the White House.

The Fed creates money out of thin air by keeping interest rates artificially low, and Trump’s complaint was that Powell wouldn’t keep interest rates as low while he was president as they did when Obama was president. But while this policy artificially heats up the economy for a time, its not sustainable growth in the long term.

Interest rates are the price of money, and like all prices they are a signal to consumers and producers on whether to spend or save money. In a real economy, interest rates would be based on the level of savings in the economy: Higher savings would lead to lower interest rates, whereas lower savings would cause interest rates to go higher. Low interest rates signal that its a good time to borrow money and get into more debt. When you keep interest rates artificially low by creating money out of thin air, you signal that it’s a good time to go into debt and borrow money even though it isn’t. You create a general level of consumer demand for money, goods, and services that isn’t real and isn’t sustainable. When you inevitably have to raise the interest rates, again artificially, to stave off price inflation, it all begins to collapse in the form of a recession.

Consumers begin to realize that they’re carrying too much debt and have to go bankrupt and/or begin to live beneath their usual means to get their debt under control. Producers find that they can no longer sustain their workforces, their levels of inventory that’s just sitting there as consumers stop buying, paying on the debt that they racked up, or paying for the long-term investments that they began during the boom phase of the bubble created by the artificially low interest rates. Unfortunately, when you keep interest rates too low for too long, your choices become raising interest rates and causing a recession, or continuing to keep interest rates low and destroying your currency through hyper-inflation as happened in Weimar Germany in the 1920’s, right before the Nazis took power, and in Zimbabwe in the early-2000’s.

The United States economy has been built on inflation, again, defined as the increase in the supply of money in relation to the amount of goods and services in the economy, for decades. After the recession in 2008 the Federal Reserve under then-chairman Ben Bernanke worked with the Bush regime in its final days and especially the Obama regime to inflate their way out of recession into another bubble. This is why the Fed kept interest rates at or near zero during Obama’s tenure, and why Trump complained when Powell tried to raise interest rates very slightly to curb inflation during his tenure: Trump didn’t want to face even a slight downturn during his time in office and wanted to keep the bubble going for political purposes the same as Obama did.

Another word for recession, however, is correction. The reason for this is because the bubble created by inflation is an aberration and it has to be corrected by liquidating the unsustainable debts and investments that were taken on, and it’s a painful time for everyone. Sometimes you can mitigate the pain by creating yet another bubble, as Bernanke and Obama did in 2008, but eventually the bill comes due and it’s possible we’re finally getting there.

For political reasons, Biden doesn’t want to admit that this is what’s happening, but those of us who have to live in this economy know what’s going on as we see prices rising on all of the things that we need to live our lives. The question is, will he allow the Fed to force us through the necessary correction, or will he try to re-inflate a bubble so that we have a worse downturn sometime in the future that presumably won’t affect his personal political prospects? We know what choice his predecessors have made, and that is why the United States economy has been nothing more than a house of cards for most, if not all, of my lifetime.